- #Microsoft excel templates simple interest plus#

- #Microsoft excel templates simple interest download#

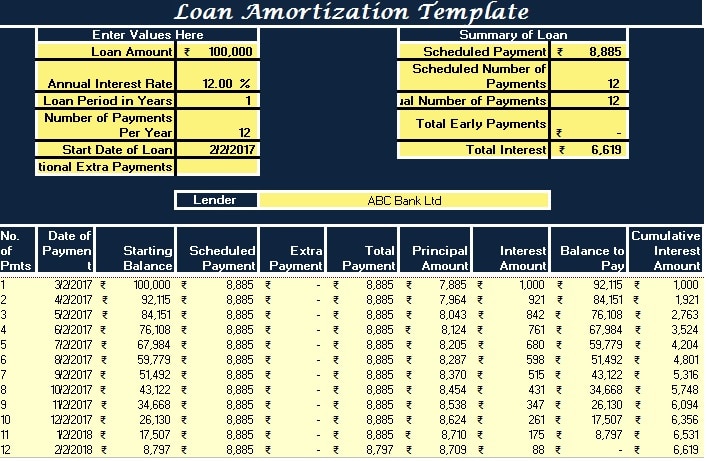

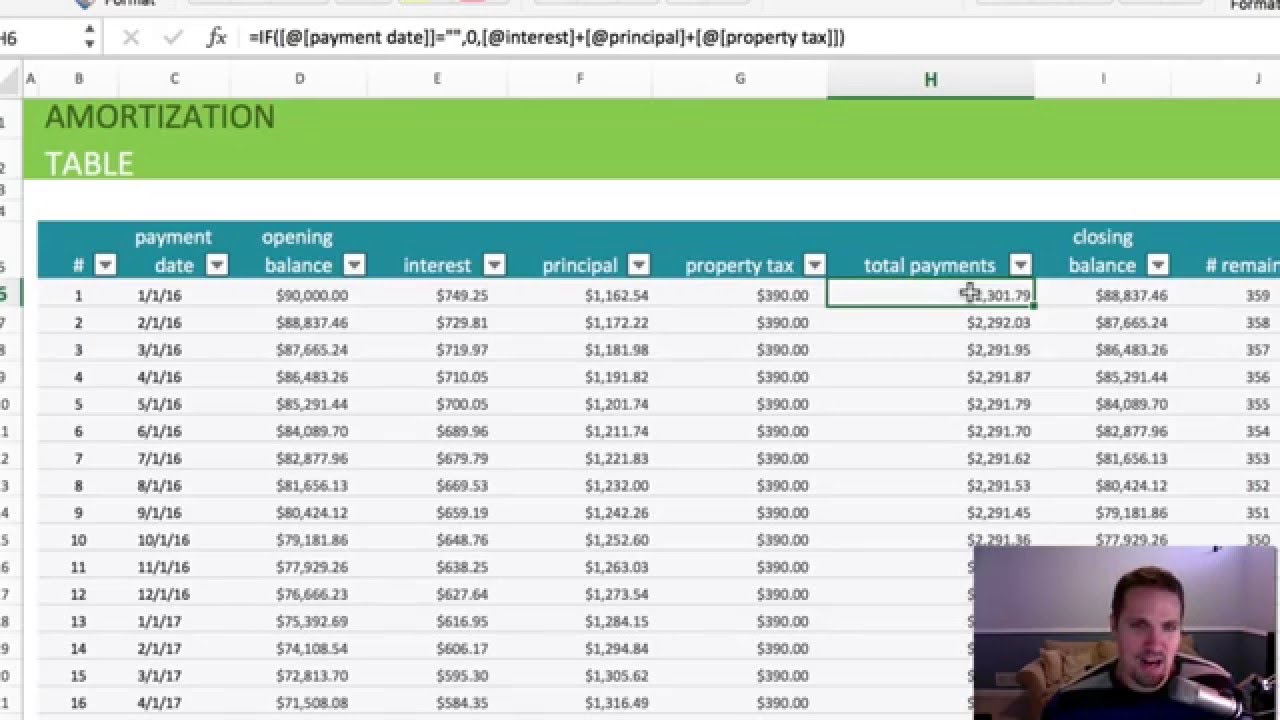

There are basic Excel loan amortization templates as well as those for home equity loans. Ending Balance. This is the remaining amount due at any period during the loan after a payment has been made.Beginning Balance. This is the amount owed on the loan that includes principal, interest, and fees.Cumulative Interest. On an Excel schedule, this shows you how much total interest you paid on a loan.Annual Interest Rate. Also called the Annual Percentage Rate (APR), this is the true cost borrowing since it includes all interest, fees, and taxes.Rate of Interest. This is the value of the payment accrued on the loan, which can be a fixed or variable rate.Total Repayment. This is the total amount you’ll pay on the loan, including principal, interest, and fees.Period of Loan. This is the term of your loan, such as a 30-year mortgage or a 60-month car loan.

For example, you take out a $200,000 mortgage or a $25,000 car loan.

#Microsoft excel templates simple interest plus#

When you “amortize” a loan, you schedule out the payments until the entire balance - the principal plus interest - equals zero.

#Microsoft excel templates simple interest download#

You can certainly make one of these schedules on your own, but this isn’t necessary since there are a ton of free loan amortization schedules for Excel that you can download and use. How you track these payments and fit them into your overall budget can be a challenge, unless you have a process and the right calculation to follow.įortunately, an amortization schedule can provide you with the exact amount due over the life of your loan and Excel can create this through various formulas. If you’ve taken out a loan or plan to do so in the future, you are committing yourself to making certain payments to the lender. Auto Loan Amortization Schedule Templates.Loan Amortization Schedule Templates for Home Equity.Mortgage Amortization Schedule Templates.General Loan Amortization Schedule Templates.Free Loan Amortization Schedule Templates for Excel.Loan Amortization Terms You Should Know.An Excel loan amortization schedule template can help you plan your loan repayment.

0 kommentar(er)

0 kommentar(er)